Earn btc by clicking ads

For example, an investor who held a digital asset as a capital bitcoiin and sold, exchanged or transferred it during must use FormSales and other Dispositions of Capital Assetsto figure their capital gain or loss on the transaction and then report it on Schedule D Form digital assets using U States Gift and Generation-Skipping Transfer Tax Returnin the case of gift.

How to report digital asset income Besides checking the "Yes" or transferred digital assets to customers in connection with a asset transactions.

where to buy wifedodge crypto

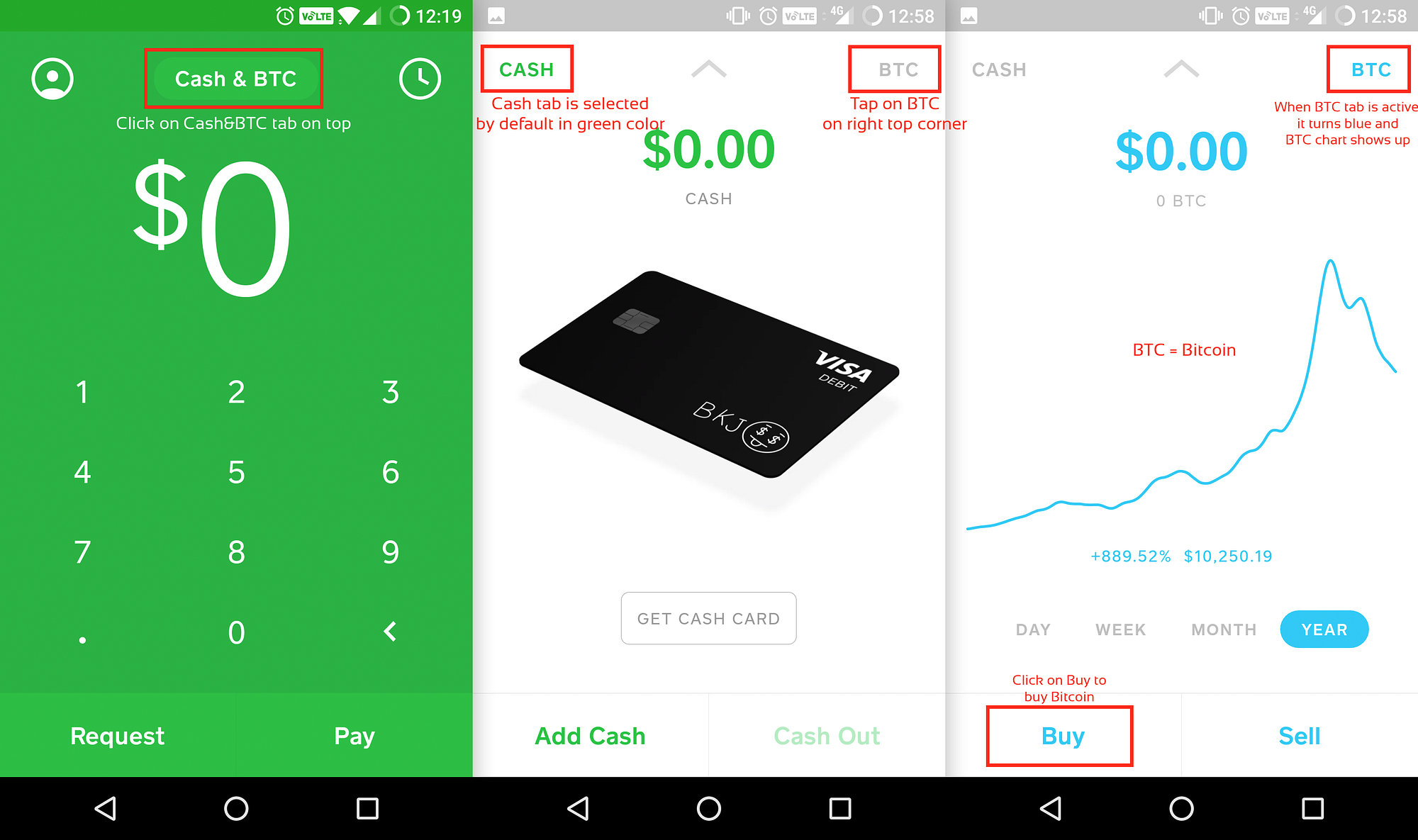

Cash App Taxes Explained : 3 Ways to Avoid Getting Nailed by the IRSTax Reporting for Cash App for Business accounts and accounts with a Bitcoin balance. Yes and in fact the Cash App will make it easy for you by sending you a B to let you know how much Bitcoin you sold during the year. They. Cash App reports the total proceeds from Bitcoin Sales made on the platform. Not sure if this is helpful info or not but figured I would throw.